Microfluidic Chip Fabrication in 2025: Unleashing Disruptive Technologies and Market Expansion. Explore How Innovation and Demand Are Shaping the Next Five Years.

- Executive Summary: Key Insights for 2025 and Beyond

- Market Overview: Defining Microfluidic Chip Fabrication

- 2025 Market Size & Growth Forecast (CAGR 2025–2030: ~18%)

- Key Drivers: Healthcare, Diagnostics, and Emerging Applications

- Technological Innovations: Materials, Manufacturing, and Miniaturization

- Competitive Landscape: Leading Players and New Entrants

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges and Barriers: Scalability, Cost, and Standardization

- Future Outlook: Trends, Opportunities, and Strategic Recommendations

- Appendix: Methodology, Data Sources, and Glossary

- Sources & References

Executive Summary: Key Insights for 2025 and Beyond

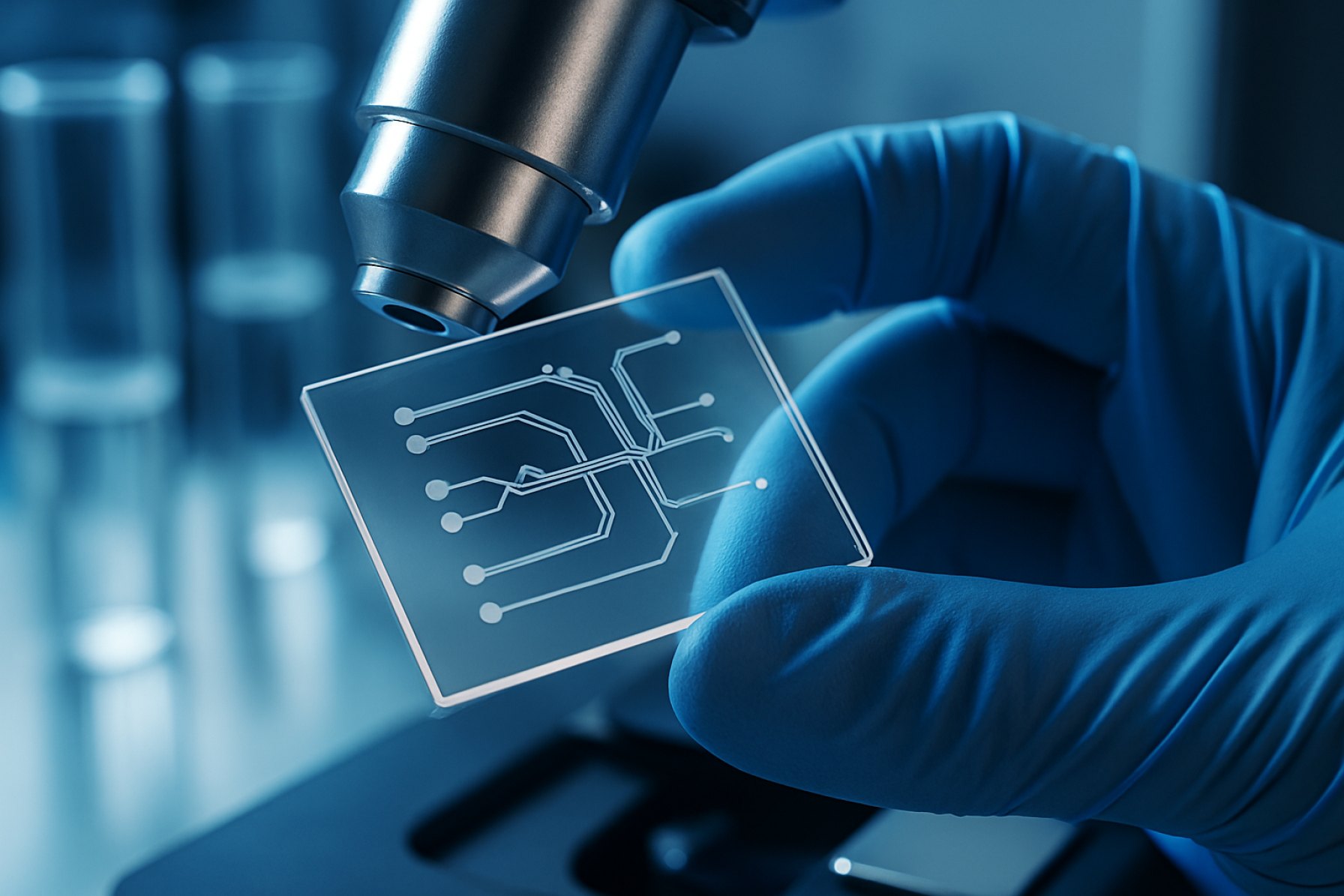

Microfluidic chip fabrication is poised for significant advancements in 2025 and beyond, driven by innovations in materials, manufacturing techniques, and application domains. The field, which centers on the design and production of devices that manipulate small volumes of fluids within microscale channels, is increasingly vital for sectors such as biomedical diagnostics, drug discovery, and environmental monitoring.

Key insights for 2025 highlight a shift toward scalable and cost-effective manufacturing methods. Traditional fabrication techniques, such as soft lithography, are being complemented and, in some cases, replaced by high-throughput processes like injection molding and 3D printing. These methods enable rapid prototyping and mass production, reducing time-to-market for new devices. Companies such as Dolomite Microfluidics and microfluidic ChipShop GmbH are at the forefront, offering standardized and custom solutions that cater to both research and commercial needs.

Material innovation is another critical trend. While polydimethylsiloxane (PDMS) remains popular for research applications, there is a growing adoption of thermoplastics and hybrid materials that offer improved chemical resistance, optical clarity, and compatibility with large-scale manufacturing. This shift is enabling broader deployment of microfluidic chips in point-of-care diagnostics and wearable biosensors, as seen in the product lines of ZEON Corporation and Covestro AG.

Integration with digital technologies is accelerating, with microfluidic platforms increasingly incorporating sensors, electronics, and wireless communication modules. This convergence supports the development of smart diagnostic devices and automated laboratory systems, aligning with the broader trend toward personalized medicine and decentralized healthcare. Organizations like Standard BioTools Inc. (formerly Fluidigm) are pioneering such integrated solutions.

Looking ahead, regulatory harmonization and the establishment of industry standards will be crucial for widespread adoption, particularly in clinical and industrial settings. Collaboration between manufacturers, regulatory bodies, and end-users is expected to drive the next wave of innovation, ensuring that microfluidic chip fabrication continues to meet the evolving demands of science and society.

Market Overview: Defining Microfluidic Chip Fabrication

Microfluidic chip fabrication refers to the process of designing and manufacturing devices with networks of tiny channels—typically ranging from tens to hundreds of micrometers in width—that manipulate small volumes of fluids. These chips are foundational to a wide array of applications, including biomedical diagnostics, drug development, chemical synthesis, and environmental monitoring. The market for microfluidic chip fabrication is experiencing robust growth, driven by the increasing demand for point-of-care testing, advancements in personalized medicine, and the miniaturization of laboratory processes.

The fabrication of microfluidic chips involves several key technologies, such as soft lithography, injection molding, hot embossing, and 3D printing. Materials commonly used include polydimethylsiloxane (PDMS), glass, silicon, and various thermoplastics. The choice of fabrication method and material depends on the intended application, required throughput, and cost considerations. For instance, Dolomite Microfluidics and microfluidic ChipShop GmbH are notable industry players offering a range of fabrication services and standardized chip platforms to meet diverse research and commercial needs.

In 2025, the market is characterized by a shift toward scalable, high-throughput manufacturing techniques to support the growing adoption of microfluidic devices in clinical and industrial settings. The integration of automation and digital design tools is streamlining the prototyping and production processes, reducing time-to-market for new devices. Additionally, collaborations between academic institutions, research organizations, and commercial manufacturers are accelerating innovation and expanding the range of available microfluidic solutions. For example, Standard BioTools Inc. (formerly Fluidigm) continues to develop advanced microfluidic platforms for genomics and proteomics, highlighting the sector’s focus on life sciences.

Overall, the microfluidic chip fabrication market in 2025 is defined by technological innovation, increasing standardization, and expanding application areas. As the demand for rapid, cost-effective, and portable analytical devices grows, the industry is poised for continued expansion, supported by ongoing investments in research, manufacturing infrastructure, and cross-sector partnerships.

2025 Market Size & Growth Forecast (CAGR 2025–2030: ~18%)

The global market for microfluidic chip fabrication is projected to experience robust growth in 2025, with industry analysts forecasting a compound annual growth rate (CAGR) of approximately 18% from 2025 to 2030. This expansion is driven by increasing demand for point-of-care diagnostics, advancements in lab-on-a-chip technologies, and the growing adoption of microfluidics in pharmaceutical and life sciences research. The integration of microfluidic chips in applications such as genomics, proteomics, and drug discovery is accelerating, as these devices enable high-throughput analysis, reduced reagent consumption, and rapid processing times.

Key industry players, including Dolomite Microfluidics, Standard BioTools Inc. (formerly Fluidigm), and Agilent Technologies, Inc., are investing in advanced fabrication techniques such as soft lithography, injection molding, and 3D printing to meet the evolving requirements of end-users. The adoption of novel materials—ranging from traditional polydimethylsiloxane (PDMS) to thermoplastics and glass—further broadens the application scope and enhances device performance.

Geographically, North America and Europe are expected to maintain significant market shares due to strong research infrastructure and funding, while the Asia-Pacific region is anticipated to witness the fastest growth, propelled by expanding biotechnology sectors and increased government initiatives. Regulatory support and standardization efforts by organizations such as the U.S. Food and Drug Administration and European Commission Directorate-General for Health and Food Safety are also facilitating market expansion by streamlining product approvals and ensuring quality standards.

Looking ahead, the microfluidic chip fabrication market in 2025 is poised for significant innovation and commercialization, with emerging trends including the integration of artificial intelligence for design optimization and the development of fully automated manufacturing platforms. These advancements are expected to further reduce production costs and accelerate time-to-market, reinforcing the sector’s strong growth trajectory through 2030.

Key Drivers: Healthcare, Diagnostics, and Emerging Applications

Microfluidic chip fabrication is increasingly driven by advancements and demands in healthcare, diagnostics, and a range of emerging applications. In healthcare, the push for rapid, point-of-care testing has accelerated the adoption of microfluidic platforms, which enable miniaturized, integrated assays for disease detection, monitoring, and personalized medicine. These chips allow for the manipulation of small fluid volumes, leading to faster reaction times, reduced reagent consumption, and the potential for multiplexed analysis. Organizations such as the National Institutes of Health have highlighted the role of microfluidics in developing next-generation diagnostic tools, particularly for infectious diseases and cancer biomarkers.

Diagnostics is a primary sector benefiting from microfluidic chip innovation. The COVID-19 pandemic underscored the need for scalable, accurate, and rapid diagnostic solutions, prompting companies like Abbott Laboratories and F. Hoffmann-La Roche Ltd to invest in microfluidic-based platforms for molecular and immunoassay testing. These chips facilitate sample preparation, amplification, and detection within a single device, streamlining workflows in clinical laboratories and enabling decentralized testing in resource-limited settings.

Beyond traditional healthcare and diagnostics, microfluidic chip fabrication is expanding into emerging applications such as organ-on-a-chip systems, environmental monitoring, and food safety. Organ-on-a-chip devices, developed by institutions like the Wyss Institute for Biologically Inspired Engineering at Harvard University, replicate physiological functions of human tissues, offering new avenues for drug screening and toxicity testing without relying on animal models. In environmental science, microfluidic chips are being used for real-time detection of contaminants in water and air, while the food industry leverages these platforms for rapid pathogen detection and quality control.

The convergence of healthcare, diagnostics, and emerging fields is shaping the future of microfluidic chip fabrication. Ongoing research focuses on scalable manufacturing techniques, integration with digital health platforms, and the use of novel materials to enhance chip performance and accessibility. As these drivers continue to evolve, microfluidic technology is poised to play a pivotal role in transforming diagnostics, personalized medicine, and a host of interdisciplinary applications.

Technological Innovations: Materials, Manufacturing, and Miniaturization

Microfluidic chip fabrication has witnessed significant technological innovations in recent years, particularly in the areas of materials, manufacturing processes, and device miniaturization. Traditionally, microfluidic chips were fabricated using silicon and glass substrates, leveraging photolithography techniques adapted from the semiconductor industry. However, the demand for cost-effective, scalable, and application-specific devices has driven the adoption of alternative materials such as polymers, including polydimethylsiloxane (PDMS), cyclic olefin copolymer (COC), and polymethyl methacrylate (PMMA). These materials offer advantages in terms of biocompatibility, optical transparency, and ease of prototyping, making them suitable for biomedical and point-of-care applications (Dolomite Microfluidics).

Manufacturing innovations have also played a pivotal role in advancing microfluidic chip technology. Soft lithography remains a popular method for rapid prototyping, but new techniques such as injection molding, hot embossing, and 3D printing are increasingly being adopted for mass production and complex geometries. Injection molding, for example, enables high-throughput fabrication of thermoplastic chips with precise microstructures, while 3D printing allows for the creation of intricate, multi-layered devices that were previously difficult to achieve (Microfluidic ChipShop GmbH). These advancements have reduced production costs and turnaround times, facilitating the commercialization of microfluidic devices.

Miniaturization is another key trend, driven by the need for portable, integrated systems capable of performing complex analyses with minimal sample volumes. Advances in micro- and nanofabrication have enabled the integration of multiple functionalities—such as pumps, valves, sensors, and detection modules—onto a single chip. This system-on-chip approach enhances device performance, reduces reagent consumption, and opens new possibilities for point-of-care diagnostics and environmental monitoring (Fluidigm Corporation).

Looking ahead to 2025, the convergence of novel materials, scalable manufacturing methods, and miniaturization is expected to further expand the capabilities and accessibility of microfluidic chip technology. These innovations are poised to accelerate the development of next-generation lab-on-a-chip platforms for healthcare, research, and industrial applications.

Competitive Landscape: Leading Players and New Entrants

The competitive landscape of microfluidic chip fabrication in 2025 is characterized by a dynamic interplay between established industry leaders and innovative new entrants. Major players such as Dolomite Microfluidics, Fluidigm Corporation, and Agilent Technologies continue to dominate the market, leveraging their extensive R&D capabilities, proprietary technologies, and global distribution networks. These companies focus on high-throughput manufacturing, integration of advanced materials, and the development of standardized platforms to cater to applications in diagnostics, drug discovery, and life sciences research.

In parallel, the market is witnessing the emergence of agile startups and university spin-offs that are driving innovation in fabrication techniques and device miniaturization. Companies such as Blacktrace Holdings Ltd and Micronit Microtechnologies are notable for their rapid prototyping services and custom chip design, enabling tailored solutions for niche research and industrial needs. These new entrants often capitalize on advances in 3D printing, soft lithography, and hybrid material integration, which allow for faster iteration cycles and lower production costs.

Collaborations between established firms and academic institutions are also shaping the competitive environment. For example, Dolomite Microfluidics frequently partners with universities to co-develop novel chip architectures and expand application areas. Meanwhile, large players are increasingly acquiring or investing in promising startups to bolster their technology portfolios and maintain a competitive edge.

Geographically, North America and Europe remain the primary hubs for microfluidic chip innovation, supported by robust funding and a strong ecosystem of research institutions. However, companies in Asia, such as Microfluidic ChipShop and Shimadzu Corporation, are rapidly scaling up their capabilities, driven by growing demand in healthcare and environmental monitoring.

Overall, the competitive landscape in 2025 is marked by a blend of consolidation among established players and disruptive innovation from new entrants, fostering a vibrant environment that accelerates the adoption and evolution of microfluidic chip fabrication technologies.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global landscape of microfluidic chip fabrication is shaped by distinct regional strengths and challenges, with North America, Europe, Asia-Pacific, and the Rest of the World each contributing uniquely to the industry’s evolution.

North America remains a leader in microfluidic chip innovation, driven by robust investments in research and development, a strong presence of biotechnology and pharmaceutical companies, and extensive academic collaboration. The United States, in particular, benefits from the support of organizations such as the National Institutes of Health and the National Science Foundation, which fund cutting-edge research in lab-on-a-chip technologies. The region’s advanced manufacturing infrastructure and established regulatory frameworks further accelerate commercialization and adoption in diagnostics, drug discovery, and environmental monitoring.

Europe is characterized by a collaborative ecosystem involving universities, research institutes, and industry players. The European Union’s emphasis on innovation, exemplified by initiatives from the European Commission, supports the development of microfluidic platforms for healthcare, food safety, and environmental applications. Countries such as Germany, the Netherlands, and Switzerland are notable for their precision engineering and microfabrication expertise. Regulatory harmonization across member states facilitates cross-border partnerships and market access.

Asia-Pacific is experiencing rapid growth in microfluidic chip fabrication, fueled by expanding healthcare needs, government investment, and a burgeoning electronics manufacturing sector. China, Japan, and South Korea are at the forefront, with significant contributions from companies like Olympus Corporation and Panasonic Corporation. The region’s cost-effective manufacturing capabilities and increasing focus on point-of-care diagnostics are driving both domestic innovation and global supply chain integration. Academic-industry partnerships and government-backed initiatives are further accelerating technology transfer and commercialization.

Rest of the World encompasses emerging markets in Latin America, the Middle East, and Africa, where adoption of microfluidic technologies is gradually increasing. While these regions face challenges such as limited infrastructure and funding, international collaborations and technology transfer initiatives are helping to bridge the gap. Organizations like the World Health Organization play a role in promoting the use of microfluidic diagnostics for infectious disease management and public health.

Overall, regional dynamics in microfluidic chip fabrication reflect varying levels of technological maturity, regulatory environments, and market drivers, shaping the global trajectory of this transformative field.

Challenges and Barriers: Scalability, Cost, and Standardization

Microfluidic chip fabrication has advanced significantly, yet several challenges and barriers persist, particularly in the areas of scalability, cost, and standardization. These factors are critical as the field moves from academic research toward widespread commercial and clinical applications.

Scalability remains a major hurdle. While prototyping microfluidic devices using soft lithography or 3D printing is relatively straightforward, scaling up to mass production introduces complexities. Traditional methods like photolithography and injection molding require expensive equipment and cleanroom facilities, making it difficult for smaller companies or research labs to transition from prototype to large-scale manufacturing. Furthermore, the integration of multiple materials and functionalities—such as valves, sensors, and electronics—into a single chip complicates the manufacturing process and can limit throughput. Organizations such as Dolomite Microfluidics and Fluidigm Corporation are actively developing scalable solutions, but widespread adoption is still limited by technical and economic constraints.

Cost is closely tied to scalability. The high initial investment in fabrication infrastructure, coupled with the cost of specialized materials (e.g., PDMS, glass, or thermoplastics), can be prohibitive. Additionally, the need for skilled personnel to operate and maintain fabrication equipment further increases operational expenses. While some companies are exploring low-cost alternatives such as paper-based microfluidics, these solutions often lack the robustness and precision required for advanced applications. Efforts by industry leaders like Agilent Technologies to streamline manufacturing processes and reduce material costs are ongoing, but significant price reductions are still needed for broader market penetration.

Standardization is another significant barrier. The lack of universally accepted design and fabrication standards leads to compatibility issues between devices and systems from different manufacturers. This fragmentation hampers the development of modular, interoperable platforms and slows regulatory approval processes, particularly in clinical and diagnostic settings. Initiatives by organizations such as the International Organization for Standardization (ISO) aim to address these issues, but the diversity of applications and rapid pace of innovation in microfluidics make consensus challenging.

In summary, overcoming the intertwined challenges of scalability, cost, and standardization is essential for the widespread adoption of microfluidic chip technologies. Continued collaboration between industry, academia, and regulatory bodies will be crucial in addressing these barriers in 2025 and beyond.

Future Outlook: Trends, Opportunities, and Strategic Recommendations

The future of microfluidic chip fabrication is poised for significant transformation, driven by advances in materials science, manufacturing technologies, and the expanding range of applications in healthcare, diagnostics, and environmental monitoring. As we move into 2025, several key trends are shaping the industry’s trajectory.

- Emergence of New Materials: The adoption of novel polymers, biocompatible hydrogels, and hybrid materials is enabling the fabrication of chips with enhanced chemical resistance, flexibility, and functionality. These materials are particularly relevant for applications in organ-on-chip and point-of-care diagnostics, where biocompatibility and performance are critical. Organizations such as Dow and DuPont are at the forefront of developing advanced materials tailored for microfluidic applications.

- Integration with Digital Manufacturing: The convergence of microfluidics with digital manufacturing techniques, such as 3D printing and laser micromachining, is accelerating prototyping and enabling the production of complex, multi-layered chip architectures. This shift is reducing time-to-market and allowing for greater customization, as highlighted by initiatives from 3D Systems and Stratasys.

- Scalability and Automation: Automated fabrication platforms are becoming increasingly prevalent, supporting high-throughput production and consistent quality. Companies like Dolomite Microfluidics are developing modular systems that streamline the transition from prototyping to mass production, addressing a longstanding bottleneck in the field.

- Regulatory and Standardization Efforts: As microfluidic devices move closer to clinical and commercial deployment, regulatory compliance and standardization are gaining importance. Bodies such as the International Organization for Standardization (ISO) are working on guidelines to ensure device safety, interoperability, and quality assurance.

Strategic Recommendations: To capitalize on these trends, stakeholders should invest in R&D for advanced materials, foster partnerships with digital manufacturing leaders, and engage early with regulatory bodies to streamline product approval. Emphasizing modularity and scalability in design will also be crucial for meeting diverse market needs and accelerating adoption across sectors.

Appendix: Methodology, Data Sources, and Glossary

This appendix outlines the methodology, data sources, and glossary relevant to the analysis of microfluidic chip fabrication as of 2025.

- Methodology: The research draws on a combination of primary and secondary data. Primary data includes interviews with engineers and product managers at leading microfluidics companies, as well as direct communication with academic laboratories specializing in microfabrication. Secondary data is sourced from peer-reviewed publications, technical white papers, and official documentation from industry leaders. The analysis emphasizes recent advancements in fabrication techniques, such as soft lithography, injection molding, and 3D printing, and considers both prototyping and mass production contexts.

- Data Sources: Key data sources include technical resources and product documentation from Dolomite Microfluidics, Fluidigm Corporation, and Microfluidic ChipShop GmbH. Standards and best practices are referenced from organizations such as the ASTM International and the International Organization for Standardization (ISO). Academic research is referenced from university microfluidics centers, including the Wyss Institute at Harvard University.

-

Glossary:

- Microfluidic Chip: A device with micro-scale channels and chambers designed to manipulate small volumes of fluids for applications in biology, chemistry, and diagnostics.

- Soft Lithography: A fabrication technique using elastomeric stamps, molds, or photomasks to create microstructures, commonly with polydimethylsiloxane (PDMS).

- Injection Molding: A mass production process where molten material is injected into a mold to form microfluidic devices, suitable for high-volume manufacturing.

- 3D Printing: Additive manufacturing methods used to build microfluidic chips layer by layer, enabling rapid prototyping and complex geometries.

- Photolithography: A process that uses light to transfer a geometric pattern from a photomask to a light-sensitive chemical photoresist on a substrate.

Sources & References

- Dolomite Microfluidics

- microfluidic ChipShop GmbH

- ZEON Corporation

- Covestro AG

- European Commission Directorate-General for Health and Food Safety

- National Institutes of Health

- F. Hoffmann-La Roche Ltd

- Wyss Institute for Biologically Inspired Engineering at Harvard University

- Micronit Microtechnologies

- Shimadzu Corporation

- National Science Foundation

- Olympus Corporation

- World Health Organization

- International Organization for Standardization (ISO)

- DuPont

- 3D Systems

- Stratasys

- ASTM International